Our Edge

Our Job is simple.

We identify good companies run by Decent Management.

Concentrate on 4 C’s:

- Common Sense

- Conviction

- Courage

- Cash

You must fight through bad days to earn the best days of your business. True for business, True for investing.

To Weather the storm, you need conviction. To create wealth, you need allocation. We increase our allocation based on our conviction. And we firmly back our conviction through

- Rigorous Fundamental Research

- Hands on approach

- Being cognizant of the pitfalls of Greed and Fear

We are particularly curious in knowing what could go wrong, than anything else.

“All I want to know where I’m going to die, so I’ll never go there.”

– Charlie Munger.

We remain conscious of the irrationality of the market and our own selves. Being aware of the existence of human biases is the first step towards minimizing them.

Isaac Newton famously said, “I can calculate the motion of heavenly bodies, but not the madness of people.”

Uninterrupted Compounding is the key to outsized wealth creation.

Our focus is on creating and maintaining a portfolio which compounds at a decent rate with the least interruption.

“No matter how great the talent or efforts, some things just take time. You can’t produce a baby in one month by getting nine women pregnant.”

– Warren Buffet.

Think in decades not years

We tend to overestimate what we can do in 3-5 years and underestimate what we can do in 10-20 years. If you desire success too soon, you’re more likely to give up too soon.

“Good investing isn’t necessarily about earning the highest returns, because the highest returns tend to be one-off hits that can’t be repeated. It’s about earning pretty good returns that you can stick with, and which can be repeated for the longest period of time. That’s when compounding runs wild.”

– Morgan Housel

We know what we own and why we own it.

“There is no way you can live an adequate life without making mistakes.”

– Charlie Munger.

We don’t see why we would be exempt from this. Mistakes are an inevitable part, while Learning is a Choice.

Securities market is more inclined towards Luck than Skill.

However, as Michel Mauboussin puts it in his book The Success Equation, in activities where luck plays a larger role, skill boils down to a process of making decisions.

Skill Shines through if there are a sufficient number of decisions (over a period of time) to weed out bad luck.

What we stand for

Signifies Happiness & Hope.

Signifies Happiness & Hope. Signifies balance & neutrality.

Signifies balance & neutrality. Under the guidance and virtues of the RBSA Group.

Under the guidance and virtues of the RBSA Group.

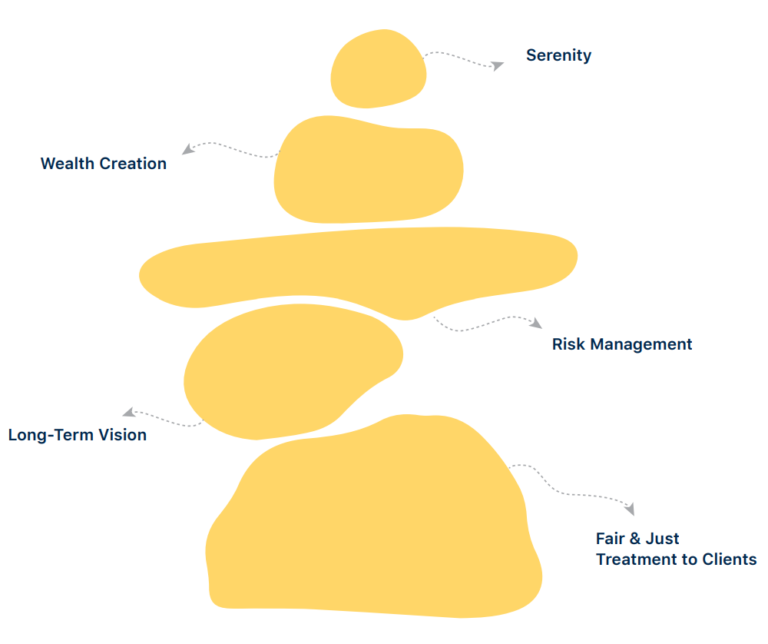

Our Bedrocks