Serenity Wealth

PMS Scheme| Fund Structure | Discretionary PMS – Open Ended |

| Benchmark | S&P BSE 500 |

| Custodian | Nuvama Custodial Services Limited |

| Minimum Investment | INR 50 Lakhs |

| Entry / Exit Load | • No Entry load. • Exit Load: 1% if redeemed before 3 years.^ |

| Fee Structure | • Only Fixed Fees, or • Only Performance-based Fees, or • Combination of Fixed & Performance based fees |

| Tax Implication | To be borne by the Client |

| Reporting Structure | • MIS - Monthly / Quarterly • Performance / Strategy Newsletter - Half-yearly |

| Redemptions | Since it’s an open-ended fund, there is no lock-in period, and any redemption requests would be processed on best effort basis up to 15/30 days*^ |

The Scheme does not invest in Alcohol, Non-vegetarian, and Meat processing companies.

*Timelines would vary based on the mode of pay-out

^ as per the agreement with the client.

Investment Strategy

Bottoms up approach

along with Top-down view

Sector agnostic

Market-cap agnostic

Potential to rerate;

Looking at companies

not actively tracked by

the investor community.

Holding Period – as long as possible,

a) If the company continues to deliver

b) Valuations do not get crazy.

Also, Special Situations such as:

Turnarounds, Mergers, Demerger,

Restructuring etc.

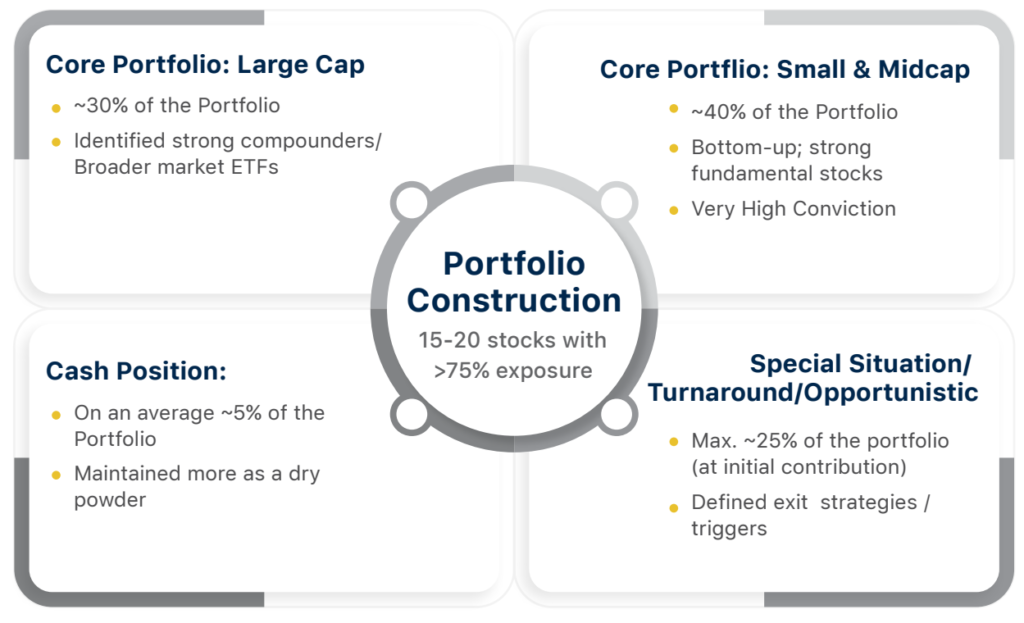

Portfolio Construction

Above is an indicative portfolio construction, actual portfolios maybe different.